Microbrewery taxes simplified; the quick guide to the complicated world of beer taxes

Taxes for a microbrewery are super complicated. It can be difficult to know what to expect, when in the planning stages of a brewery. The following article is a guest post by Daniel Hicks that gives a good overview of what you need to know when it comes to paying taxes on the beer you brew.

How Microbrewery Taxes Really Work

A common question I get asked is, “How do microbrewery taxes work?” Depending on who is asking the question, and whether or not we both have enough beer in hand to discuss the process without getting a headache, I give them one of two answers.

The simple answer is breweries (and brewpubs) pay federal taxes on beer that has been sold. Once money has been exchanged for your beer, Uncle Sam wants his cut of the action.

The complicated part of the taxes question is figuring out how much taxes should be paid, when they need to be paid, and the paperwork process involved in making sure everything is reported properly.

But before we go any further…

Disclaimer: Use of any information from this article or any other website referred to in this article is for general information only and does not represent personal or commercial tax advice either express or implied. You are encouraged to seek professional tax advice for tax questions and assistance.

Ok, you’ve been warned.

Down the taxes and operations reporting rabbit hole

If you’ve already been seriously researching how to start a brewery, or if you’re already wading neck deep in the process, no doubt that you’ve heard of the Alcohol and Tobacco Tax and Trade Bureau (TTB). This agency handles all of the Federal regulatory issues, paperwork, and licensing for breweries.

Federal excise taxes for breweries are closely intertwined with another set of documents called the Brewer’s (or Brewpub) Report of Operations (BROP). The BROP reports describe how much beer was made, how it’s being stored (bulk, kegs, bottles/cans), as well as accounting for beer that might have been used for testing, moved from a different location, sent for export, or even destroyed or missing/stolen. Essentially, if you make beer commercially you will need to account for ALL stages of the beer’s life until it’s either drank by a happy customer in your tasting room or shipped out the door for sale.

There are 2 versions of the BROP: Form 5130.9 for Breweries or Form 5130.26. These forms and their instructions can be found on the TTB website at: http://www.ttb.gov/beer/beer-forms.shtml.

The Excise Tax form is known as Form 5000.24.

How much tax you pay, when you pay them, and when the BROP and excise reports need to be filed all depends on how much beer you plan on making and how much taxes you plan on paying over the whole year.

BROP Reports – Forms 5130.9 and 5130.26

Form 5130.9 is a more elaborate operations form based on the old (pre-2015) standard form for breweries. Larger breweries will need to report using Form 5130.9. It been slightly simplified as you no longer need to report on ingredients used.

Form 5130.26 is a simpler form based on the old standard form for brewpubs. Smaller breweries and brewpubs can both use Form 5130.26 for operations reporting.

The amount of tax you owed last year and the amount of tax you plan on owing this year determine which form you should use for your operations reporting.

If your tax liability was more than $50,000 last year (if you were in business) or you plan on it being more than $50,000 this year, you need to file your operations report monthly using Form 5130.9.

If your taxes were less than $50,000 last year and you plan on owing less than $50,000 this year, you can file your operations reports quarterly, and you have the choice of using either Form 5130.9 or Form 5130.26.

The due date for all operations reports is the 15th day after the end of the month in which it is due. For example, if you file your reports monthly, your March report must be filed by April 15. If you file your reports quarterly, your Quarter 3 report (which ends September), must be filed by October 15.

The TTB provides a list of the most common BROP reporting problems on their website. The most common mistakes are from math errors or misinterpreting what is required on the forms. Unfortunately, the forms are not intuitive and mistakes are easy to make. When in doubt, ask. Your TTB agent will be able to provide an official answer to your questions.

We’ve put together a pdf that explains the most common pitfalls people have with the BROP reports. Check it out and download it here.

Excise Tax – Form 5000.24

The standard due dates for filing Form 5000.24 and paying tax is twice per month (semi-monthly) except for September. In September, taxes are due a total of 3 times and these dates vary depending on if you plan on mailing a check or paying by electronic funds transfer (EFT). More information about September rules can be found in the Code of Federal Regulations (CFR) §25.164a.

If you paid less than $50,000 last calendar year and you plan on owing less than $50,000 this year, than you have the option to pay taxes and file your return quarterly.

As of January 1, 2017, if you paid less than $1,000 last calendar year and you plan on owing less than $1,000 this year, then you have the option to pay taxes and file your return annually.

If for some reason your brewery bonds become insufficient (bonds are a whole other discussion) or if you become delinquent on tax payments, you will be “asked” to start pre-paying your taxes. You will then need to file an Excise Tax report and prepay tax before any consumption or sale. Additionally, you will also have to file an additional semi-monthly Excise Tax report that essentially reviews all of the prepaid taxes during that period. Your job as a brewer can quickly turn into that of an accountant if you are required to pre-pay your taxes. Avoid at all costs!

The due dates for the semi-monthly and quarterly tax scenarios can be found at http://www.ttb.gov/tax_audit/fed_ex_tax_due.shtml. The due date for the annual return option is January 14 of the next year.

The standard tax rate for beer is $18 per barrel. You may qualify for a reduced tax rate of $7 per barrel for the first 60,000 barrels you produce if you plan to produce less than 2 million barrels in that calendar year. After you’ve reached 60,000 barrels the tax rate jumps back to $18 per barrel.

Note that an Excise Tax Return form 5000.24 is due even if no tax is owed!

Staying organized is the key

If there’s some advice that I can give to help brewers with their taxes and reporting, the first piece would be to get organized!

Brewers are required by the TTB to keep daily records. However, most of the brewers I’ve talked to don’t do enough organizing up front before the taxes and reports are due. Because of this, the typical amount of time it takes to prepare these reports correctly is one or 2 days.

Invest in more filing cabinets than you think will be necessary or spend some time brushing up on your spreadsheet skills, so that all of the information is at your fingertips when you need it. Few things are more frustrating than trying to hunt down a missing brew log under a looming deadline from the TTB.

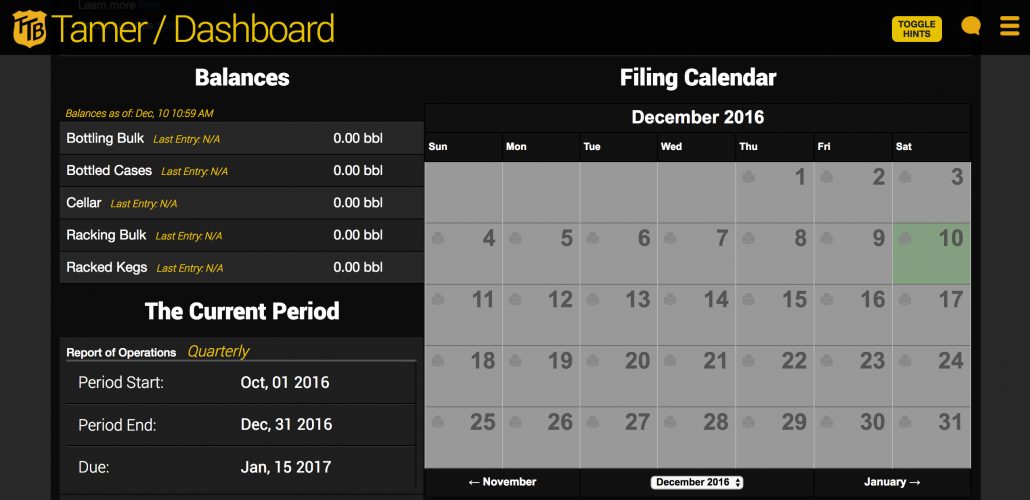

The second piece of advice I can offer is to give our product, TTB Tamer, a test drive with a free trial. TTB Tamer is an online tool where all of your brewery operations reports can be stored as they happen. Then when a report is due, all you need to do is click “print” and the correct forms are printed out for you.

After that, just mail in the form with any payments. This can significantly reduce the amount of time required for generating reports and determining how much tax is due.

In addition to Daily Records, Report of Operations, and Excise Tax form, TTB Tamer can help you with state reporting requirements.

More information about TTB Tamer can be found at ttbtamer.com.

So as you can see, tax and reporting requirements are definitely not small parts of the brewery operation. I hope this helps shed some light on what the processes are like.

NOTE: There have been ongoing efforts to reduce the tax rate for small brewers. As of the time of this writing the tax rates changes have yet taken place, but who knows what’s in store for 2017!

ED NOTE: This post was originally published on April 21, 2014. There have been significant enough changes that update this piece and change the date.

Image showing New Dollar Bill by Dave Winer on flickr (CC BY-SA 2.0) was modified from its original state.

Join the mail list

Don’t miss other great posts like this one.

Sign up for the email list: Sign me up!